Effective Ways to Calculate Consumer Surplus in 2025: A Practical Guide

“`html

Effective Ways to Calculate Consumer Surplus in 2025

Understanding Consumer Surplus

Consumer surplus is a vital concept in welfare economics, representing the difference between what consumers are willing to pay and what they actually pay for goods and services. This value not only allows us to gauge consumer welfare but also offers insight into overall market efficiency. In this section, we will define **consumer surplus**, explore its significance in economic theory, and how it relates to **consumer behavior** and market dynamics. By recognizing the essential features of **consumer surplus**, stakeholders can better analyze market performance and make informed decisions.

Consumer Surplus Definition

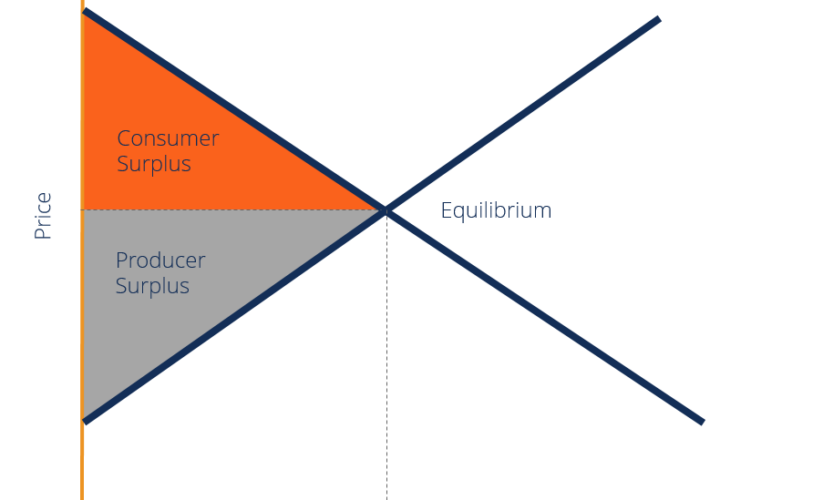

At its core, **consumer surplus** refers to the economic benefit that consumers receive when they pay a price lower than their willingness to pay. This concept can be graphically represented using a downward-sloping **demand curve**, where the area above the market price and below the demand curve indicates the surplus generated from consumer purchases. For instance, if the market price for a product is $50, but consumers are willing to pay $70, the **surplus calculation** would show that each consumer gains $20 in value, thereby contributing to total market welfare.

Factors Affecting Consumer Surplus

<pNumerous factors influence the amount of **consumer surplus** in a given market. Key determinants include **price elasticity**, societal income levels, and general economic indicators. When demand is inelastic, consumers maintain a relatively high willingness to pay despite price changes, leading to a more considerable surplus. For example, in a scenario where the **market price** of essential goods increases, some consumers may still derive benefit due to their unchanging necessity perception, demonstrating that **consumer satisfaction** often relies on price-sensitive factors.

Measuring Consumer Surplus in Practice

Effective measurement of **consumer surplus** involves several methodologies. Graphical representation remains crucial, as it visually articulates areas of surplus on demand curves. Moreover, periodic **demand forecasting** enables analysts to predict shifts in consumer preferences and demand, subsequently influencing surplus calculations. Adopting tools and techniques, along with **behavioral economics**, helps delineate trends within **consumer buying behavior**, ultimately driving enhanced **market efficiency** and contributing to more precise **surplus measurement**.

Methods of Calculating Consumer Surplus

Accurately calculating **consumer surplus** entails using various methodologies that incorporate market data, demand elasticity, and consumer preferences. These methods not only ensure precision but also empower businesses and policymakers to make informed decisions. This section will delve into practical methods for calculating consumer surplus, focusing on real-world applications and their implications for market analysis.

Graphical Representation of Consumer Surplus

The graphical representation method provides a clear visual framework for understanding **consumer surplus**. By plotting the **demand curve** against the **market price**, stakeholders can directly observe the surplus area. In practical applications, businesses can leverage these graphs to assess product viability. For instance, if following market research, a company anticipates a demand shift, they can utilize these visuals to predict **consumer preferences**. Additionally, training staff on utilizing visual tools enhances their ability to communicate findings effectively to management.

Using the Consumer Surplus Formula

The formula for calculating **consumer surplus** is essential for accuracy in economic assessments. The basic equation is given by the area of a triangle:

Consumer Surplus = 1/2 × Base × Height,

where the base represents the quantity of goods purchased and the height represents the difference between the highest price consumers are willing to pay and the actual market price. This robust method effectively evaluates different scenarios such as **price discrimination** and the impact of **market changes** on economic welfare.

Case Study: Consumer Surplus in Action

A real-world example of consumer surplus can be observed in the renewable energy sector. As demand for **green technologies** grows, studies reveal that early adopters are often willing to pay significantly more than the production costs. This willingness creates a notable **consumer surplus** that can encourage further innovations within the industry. Furthermore, understanding how shifts towards sustainable energy affect pricing can significantly alter **demand forecasting** and influence resource allocation in economic models.

Implications of Consumer Surplus on Market Efficiency

The implications of **consumer surplus** extend well beyond individual preferences. They serve as a gauge of overall **market efficiency**. This section discusses how consumer surplus reflects **social welfare**, its relationship with **producer surplus**, and aids in determining the overall health of an economy.

Relationship Between Consumer Surplus and Producer Surplus

The relationship between **consumer surplus** and **producer surplus** is critical in understanding total economic welfare, often summarized as total surplus. As markets find their **equilibrium**, both surpluses reflect societal benefits within resource allocation. When investigating market monopolies, it’s crucial to assess how practices may minimize consumer surplus while maximizing producer profits, ultimately leading to potential deadweight loss in the economy.

Effects of Price Discrimination on Consumer Surplus

Price discrimination—charging different prices for the same product—primarily impacts **consumer surplus**. By leveraging consumer insights, businesses can maximize revenues while affecting the overall supply dynamic. In essence, when prices are adjusted based on individual willingness to pay, it may lead to an overall increase in total economic surplus, despite its varying effects on individual consumers.

Public Policy and Consumer Surplus

Policy implications of consumer surplus are significant in crafting economic policy, especially regarding taxation and subsidies. Governments may analyze consumer surplus outcomes to ensure welfare gains from allocated resources outweigh the costs incurred. Data on consumer preferences allows for refined approaches in evaluating economic policy effectiveness while ensuring consumer interests are protected, fostering competition and economic growth.

Consumer Surplus and Future Trends

As market dynamics evolve, so do the methods of evaluating **consumer surplus**. Innovations in data analytics, behavioral economics, and emerging technologies like AI are set to refine how we measure consumer welfare. In this section, we explore expected trends and how they will continue to shape our understanding of consumer surplus in the broader economic landscape.

Role of Big Data in Surplus Measurement

Big data offers unprecedented advantages in assessing **consumer surplus** with respect to ever-changing market conditions. Companies can analyze vast amounts of consumer data to identify and quantify shifts in demand and preferences, improving the accuracy of surplus analysis. Such insights facilitate more effective pricing strategies that enhance overall market welfare and optimization of resource allocation.

Behavioral Factors Influencing Consumer Buying Behavior

Recognizing **behavioral factors** offers a new lens for evaluating how consumers make their purchasing decisions. Psychological elements, such as perceived value and trust, can play a significant role in shaping consumer surplus. As researchers explore the nuances of consumer decision-making, businesses may adjust strategies to better align with findings, ultimately maximizing economic values derived from **consumer behavior** insights.

Future Trends in Consumer Welfare Measurement

Looking ahead, developments in economic models that account for **market inefficiencies** and **demand elasticity** will become increasingly pivotal. Integrating comprehensive behavioral analysis and advanced statistical methods will enhance the measurement of consumer surplus. As governments and firms focus more on consumer welfare outcomes, these evolving practices will foster an environment conducive to beneficial resource allocation and increased **economic efficiency**.

Key Takeaways

- Consumer surplus indicates consumer welfare by showing the difference between willingness to pay and actual market prices.

- Graphical representation and formulas are essential for accurate measurements of consumer surplus.

- Consumer surplus is related to producer surplus, indicating overall economic health and resource efficiency.

- Policy implications are influential in assessing consumer surplus outcomes and driving economic strategies.

- Future trends point to big data and behavioral economics playing critical roles in refining surplus analysis.

FAQ

1. What is the economic definition of consumer surplus?

**Consumer surplus** refers to the financial gain obtained by consumers when they purchase a product for less than they are willing to pay. It’s calculated as the area between the **demand curve** and the market price, illustrating market benefits for consumers while assessing overall **economic welfare**.

2. How can changes in price affect consumer surplus?

Price changes directly affect **consumer surplus** levels, either enhancing or diminishing it. When prices rise, consumer surplus typically decreases as fewer individuals see value in purchasing a product at higher costs. Conversely, price reductions may increase surplus as more consumers experience additional satisfaction from the purchase.

3. What is the relationship between consumer surplus and total welfare?

The **consumer surplus** is key to total economic welfare, representing the net benefit enjoyed by consumers. When combined with **producer surplus**, it quantifies the efficiency of markets, thereby facilitating a better understanding of resource allocation within an economy.

4. How does consumer surplus relate to market efficiency?

**Consumer surplus** is a crucial indicator of **market efficiency**. Higher surplus levels suggest that consumers derive significant benefits from market transactions, whereas lower levels indicate potential market failures or monopolistic practices that restrict consumer welfare.

5. Can consumer surplus be measured in monopolistic markets?

Yes, although measuring **consumer surplus** in monopolistic markets can be challenging due to price-setting power. Monopolies may restrict output and increase prices, thereby potentially reducing overall consumer surplus in relation to competitive markets, thus creating **deadweight loss**.

“`