How to Properly Find Retained Earnings for Effective Financial Planning in 2025

How to Properly Find Retained Earnings for Effective Financial Planning in 2025

Understanding retained earnings is crucial for both financial planning and a company’s overall growth strategy. Properly calculating and managing retained earnings can significantly impact your business’s financial health. In this article, we will explore how to find retained earnings, including essential methods, formulas, and the role retained earnings play in effective financial management for the year 2025 and beyond.

Understanding Retained Earnings

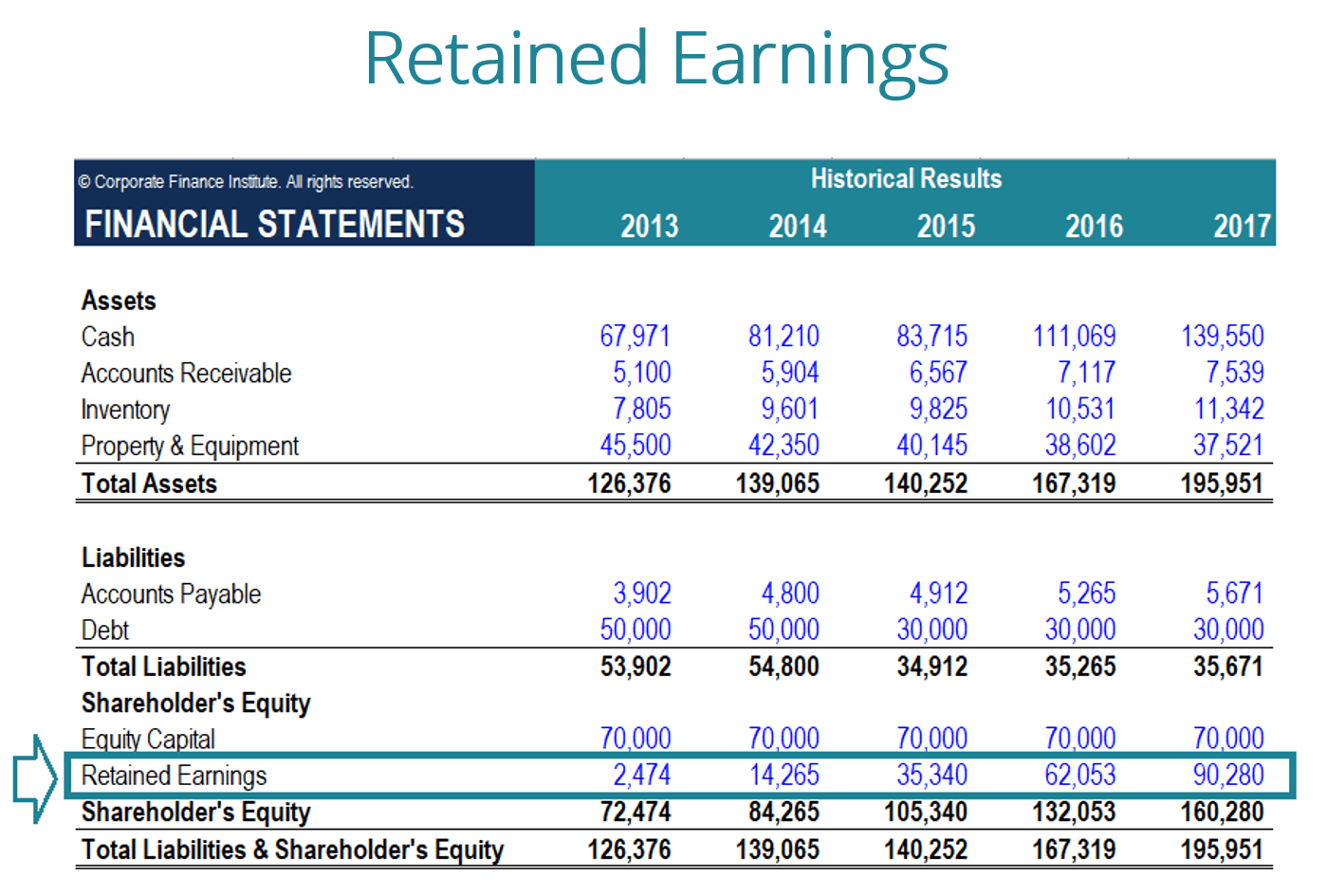

Retained earnings refer to the accumulated net income that a company retains rather than distributing to shareholders as dividends. This financial metric is essential for investors and company management to understand the importance of retained earnings for business growth and stability. Retained earnings can be found on a company’s balance sheet and are influenced by various factors including profit margins, company policies on dividends, and overall financial performance.

Retained Earnings Definition

The retained earnings definition encompasses the cumulative amount of net income that has been retained within a company’s equity structure since its inception. In simpler terms, retained earnings = total earnings – dividends paid. These funds are often reinvested in the business or used to pay off debts. Understanding this definition is foundational for anyone looking to perform a retained earnings calculation.

Importance of Retained Earnings in Accounting

From an accounting perspective, retained earnings play a significant role in portraying a company’s profitability over a period of time. This is where the retained earnings formula becomes essential. Accountants use this to calculate the business’s ability to self-finance and grow organically. The retained earnings are reflected in financial statements, affecting financial ratios and providing deeper insights into capital management.

Retained Earnings Overview

Retained earnings provide insight into company performance and shareholder equity. Investors analyze retained earnings to understand a company’s past profitability and its potential for reinvestment and growth. This evaluation helps stakeholders make informed decisions regarding investments and financial strategies, highlighting the significance of maintaining a positive retained earnings balance for company sustainability.

Calculating Retained Earnings

Effective financial planning heavily relies on accurate calculations of retained earnings. Understanding how to calculate retained earnings is crucial for business owners and accounting professionals. Below, we look at various approaches to performing this vital calculation, as well as examples to illustrate each method.

Retained Earnings Calculation Steps

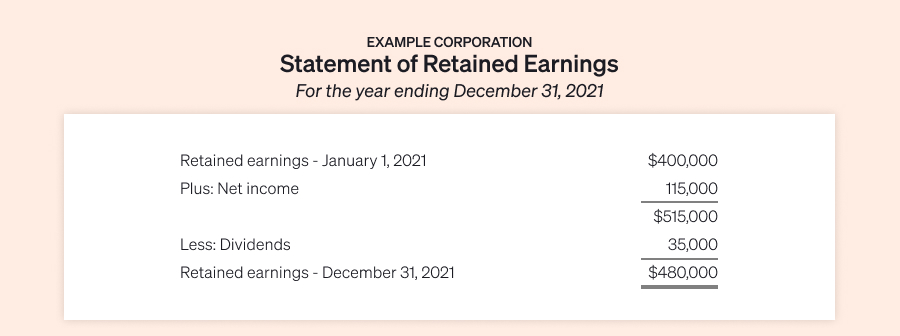

To perform the retained earnings calculation, follow these steps:

- Determine the beginning balance of retained earnings.

- Add net income for the period to the starting amount.

- Subtract any dividends paid to shareholders.

- Conclude with the ending retained earnings balance.

This structured approach using the retained earnings worksheet allows for clear tracking of changes and projections moving forward. This method can be used on a monthly, quarterly, or annual basis, depending on the needs of the organization.

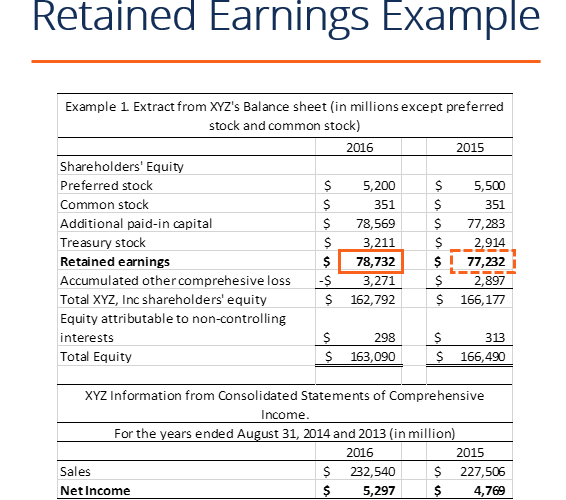

Retained Earnings Example

Consider a hypothetical company that starts with a retained earnings balance of $50,000. If it earns a net income of $20,000 in a fiscal year but distributes $10,000 as dividends, the calculation would be as follows:

Ending Retained Earnings = Beginning Balance + Net Income – Dividends

This translates to: $50,000 + $20,000 – $10,000 = $60,000. This example highlights the importance of retained earnings in understanding your company’s financial trajectory.

Retained Earnings Adjustment

Occasionally, adjustments to retained earnings may be needed due to accounting corrections or changes in financial reporting principles. Common adjustments include correcting prior period errors or retrospective application of new accounting standards. Understanding the retained earnings adjustment process is essential for accurate financial reporting and compliance. Each adjustment should be documented correctly in financial statements to maintain transparency and data integrity.

Retained Earnings Management Strategies

Managing retained earnings is vital for strategic business operations. A clear understanding of your company’s financial position can guide crucial decisions regarding reinvestment versus dividend distribution. Below are effective strategies for managing retained earnings.

Retained Earnings Policy

A definitive retained earnings policy provides a framework for decision-making related to profit retention. Companies must balance the need for reinvestment—vital for growth and expansion—against distributing profits to shareholders. Establishing a policy can entail setting minimum retained earnings thresholds and defining circumstances that justify higher levels of cash distributions. This strategic approach enhances financial stability and investor confidence.

Retained Earnings Tracking

Effective retained earnings tracking involves utilizing software tools or management systems aimed at reporting and analyzing retained earnings regularly. Regular tracking enables businesses to make informed decisions based on historical data trends, which can positively influence financial planning and corporate governance. Financial managers should leverage retained earnings analysis to evaluate the efficacy of operational strategies in driving company growth over time.

Retained Earnings and Dividends

Understanding the relationship between retained earnings versus dividends is crucial. When companies decide to distribute profits as dividends, less is retained for growth. Executives must balance dividend distributions with the need for reinvestment and business sustainability—a crucial factor in fulfilling shareholder obligations while also investing in future growth. This analysis informs dividend policies that work alongside overall corporate strategy.

Key Takeaways

- Accurate calculation of retained earnings is pivotal for effective financial management.

- Retained earnings contribute significantly to corporate financial health and growth strategy.

- Implementing robust tracking and adjustment processes can enhance financial reporting accuracy.

- A well-defined retained earnings policy supports informed investor relations and strategic decision-making.

FAQ

1. What is the retained earnings statement?

A retained earnings statement provides a detailed breakdown of the changes to retained earnings over a specific period, typically aligning with the company’s fiscal year. This statement reports the beginning retained earnings, net income, dividends paid, and ending retained earnings balance—showing how profit distribution impacts overall company equity.

2. How does retained earnings impact cash flow?

Retained earnings impact cash flow in various ways. Reinvested profits can enhance operational capacity and drive revenue growth, thus potentially increasing future cash flows. Conversely, significant dividends affect liquidity and the funds available for ongoing business development. Understanding this relationship can significantly affect financial planning and investment decisions.

3. What are the common adjustments made to retained earnings?

Common retained earnings adjustments include correcting accounting errors or implementing retrospective accounting policy changes. Such adjustments ensure the accuracy of retained earnings reflected in financial statements and constantly align with the company’s governing financial reporting standards. Proper documentation of these changes is important for maintaining transparency with stakeholders.

4. How can retained earnings affect business valuation?

Retained earnings affect business valuation as they signal a company’s profitability and financial health. Higher retained earnings suggest that a company has not only been consistently profitable but also is likely to use profits for growth initiatives, enhancing overall value—and investor confidence. Therefore, retained earnings play a critical role in business valuation assessments.

5. Why is retained earnings management crucial for large corporations?

Retained earnings management is essential for large corporations, as it influences critical strategic decisions regarding expansion, research, development, and sustainability. Effective management aligns retained earnings with long-term financial goals, helping large companies balance shareholder returns with reinvestment needs vital for ongoing growth and competitiveness.

6. What methodology can I use to forecast retained earnings?

Forecasting retained earnings typically involves projecting future profits, estimating potential dividends, and analyzing past trends. Commonly used methodologies include trend analysis, regression models, or smoothening historical data to obtain realistic expectations of future retained earnings movements. A comprehensive forecasting model is crucial for both short-term planning and long-term strategic objectives.

7. Can retained earnings contribute to lost financial connections?

Yes, incorrect management or insufficient tracking of retained earnings can lead to a disconnect in financial reporting, resulting in lost confidence from stakeholders. Transparent reporting and strategic disclosure of retained earnings trends and adjustments foster trust and facilitate clearer communication, which is crucial for effective governance and shareholder relations.

By prioritizing insights and strategies for understanding and managing retained earnings, businesses can better prepare for effective financial planning and execution in the growing demands of the future.