Smart Ways to Become an Accountant in 2025: Essential Steps for Success

“`html

How to Become an Accountant in 2025: Steps for Success

Becoming an accountant is a rewarding venture that promises growth and stability in the financial sector. As we look ahead to 2025, understanding the essential steps to forge a successful accounting career is essential. By embracing the upcoming trends and mastering key competencies in the field, aspiring accountants can set themselves up for a prosperous future. This article outlines the critical steps, educational pathways, and certifications required for those interested in this dynamic profession.

Understanding Accountant Education Requirements

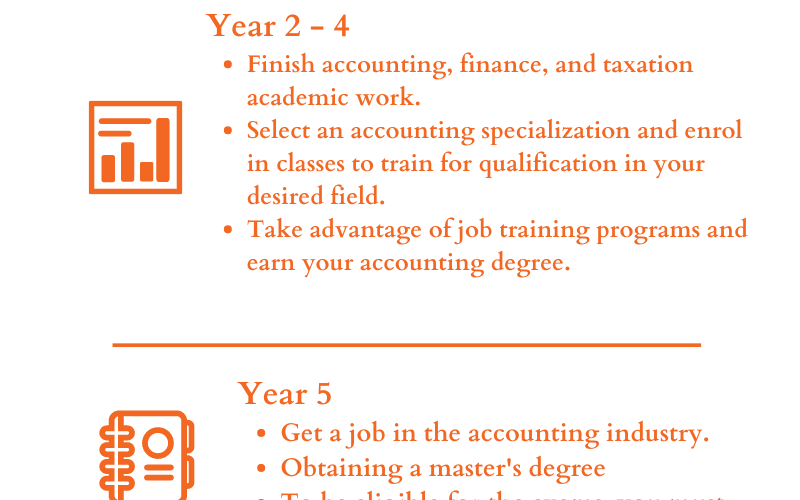

To embark on the accounting career path, one must first meet the essential accountant education requirements. Typically, a bachelor’s degree in accounting or finance is fundamental. Many universities offer comprehensive accounting degree programs that cover crucial topics, such as financial reporting standards, budgeting skills for accountants, and accounting ethics and integrity. Additionally, students should consider specializing in fields such as auditing, tax accounting basics, or financial accounting courses, as these specializations can enhance job market opportunities.

Choosing an Accounting School

Selecting an accredited institution is a key factor in receiving a solid education in accounting. Not only should aspiring accountants look for institutions with strong academic reputations, but they should also consider the availability of resources such as accounting internships and networking opportunities. A well-designed school program will typically include study tips for accounting, career counseling services, and access to esteemed faculty who possess industry experience. Prospective students would also benefit from evaluating alumni success stories as a measure of the institution’s effectiveness in shaping career opportunities.

Financial Accounting Courses and Practical Training

Engaging in financial accounting courses

is a must. These courses not only provide foundational knowledge but also foster essential skills. Courses such as management accounting and financial analysis techniques are invaluable. Furthermore, actively seeking internship opportunities for accounting students allows for practical experience to complement academic learning. An internship is a practical step that arms students with the bookkeeping skills necessary in real-world scenarios, and reinforces the classroom lessons through hands-on experience.

Certification: An Essential Step

For aspiring accountants, pursuing relevant accounting certifications is crucial for career advancement. One of the most recognized certifications is the Certified Public Accountant (CPA) designation, which emphasizes professional expertise and integrity in accounting practices. For many firms, CPA certification is a requirement for senior positions. Moreover, there are other certifications in specialized areas, such as Certified Management Accountant (CMA) and Certified Internal Auditor (CIA), providing a roadmap for career specialization.

Gaining Experience: The Role of Internships

Internships are pivotal in the sector, equipping aspiring accountants with necessary acquirements and offering insights into the accounting job market. Such practical experience enhances an applicant’s resume, showcasing their readiness to navigate the nuances of real-world accounting tasks. Engaging in internships allows an individual to apply their knowledge and receive mentorship from seasoned professionals, an invaluable resource in understanding the differences between public accounting vs private accounting.

Benefits of Accounting Internships

Internships not only bridge the gap between theory and reality but also open doors to future job placements. Many employers prefer applicants with internship experience, as it reflects commitment and seriousness about the accounting profession. Through these practical experiences, interns can improve their understanding of tax laws and develop critical soft skills, such as effective communication skills for accountants, which are essential in client interactions and formal presentations. Overall, internships present an opportunity to explore various accounting specializations and gauge personal interests in areas such as auditing or taxation careers.

Networking for Success in Accounting

Building a professional network is essential for career growth in accounting. Engaging in community events or joining professional accounting associations can facilitate valuable connections. One critical component of this networking is joining industry-specific organizations, such as the American Institute of CPAs (AICPA) or local accounting firms. Through these platforms, aspiring accountants can seek mentorship and gain insights about achieving success in their careers. Effectively, networking opens pathways to potential job opportunities and resources for continuing education for accountants.

Skill Development: Essential Qualities of a Successful Accountant

In addition to formal education and practical experience, a successful accountant must possess various essential skills needed for accountants. These include proficiency in accounting software, an analytical mindset, and the ability to work under tight deadlines. Furthermore, accountants must master accounting principles and stay updated with the evolving trends that signify the future of accounting careers.

Developing Analytical and Problem-Solving Skills

Strong analytical skills are paramount in accounting, enabling professionals to interpret data accurately and make informed economic decisions. Throughout their career, accountants should prioritize ongoing development in this area by taking specialized courses or utilizing resources related to financial analysis techniques. Engaging in case studies and practical problems serves to cultivate the problem-solving skills crucial within the accounting landscape.

Mastering Communication and Organizational Skills

Accountants must not only be strong analysts but should also excel in communication. Effective communication skills for accountants facilitate better teamwork and client relations, enabling accountants to explain complex financial data in simple terms. Additionally, superior organization skills are a necessity to ensure compliance with financial regulations for accountants and accuracy in reporting. Professionals should seek out opportunities to hone these skills through workshops, courses, and on-the-job training.

Embracing Technology in Accounting

The impact of technology on accounting practices cannot be overstated. With a growing range of accounting technology solutions, accountants must be aware of the tools available to them. Proficiency in accounting software becomes a differentiating factor in the accounting job market. Accountants should actively pursue certifications in using prominent accounting tools, enabling them to leverage these technologies for improved efficiency and accuracy.

Advancing Your Career: Continuing Education and Certifications

The accounting field is dynamic and warrants a commitment to lifelong learning. The requirement for continuing education for accountants underscores the importance of keeping updated with new laws, technologies, and best practices in financial reporting. Accounting professionals are encouraged to participate in workshops, seminars, and online accounting courses, staying informed about critical financial compliance requirements and regulations.

Understanding the Importance of Ethics in Accounting

Ethics in accounting remain a core focus, emphasizing accountability and integrity in every transaction and report. Aspiring accountants should familiarize themselves with the importance of accounting ethics, coupling their technical endeavors with a strong moral compass in the financial environment. Mastering ethical standards not only influences personal growth but profoundly impacts the organization’s credibility and trustworthiness.

Preparing for the CPA Exam

The journey towards becoming a Certified Public Accountant (CPA) is marked by rigorous examination preparation. Candidates should invest time in understanding the structure and content of the CPA exam. Enrolling in preparatory courses or utilizing prep resources can enhance the chances of passing. Remember, aspiring CPAs should develop robust study schedules employing proven study tips for accounting that accommodate different learning styles and reinforce key topics.

Salary Expectations for Accountants

As accountants gain experience and credentials, understanding salary expectations for accountants becomes important. Entry-level positions might have modest beginning salaries that grow with time, experience, and qualifications. Factors influencing salary trajectories include choice of specialization and work environment—gravitating towards public accounting generally offers various compensation structures compared to private or corporate settings.

Key Takeaways

- Understanding the necessary educational qualifications and certifications is crucial for aspiring accountants.

- Practical experience through internships is advantageous for developing skills and building professional networks.

- Essential skills like analytical thinking and effective communication enhance career prospects significantly.

- Commitment to continuing education strengthens professional integrity and keeps accountants updated on industry standards.

- Salary growth typically aligns with gaining experience and advanced specializations.

FAQ

1. What are the main differences between bookkeepers and accountants?

The primary distinction lies in the scope of work; while bookkeepers manage day-to-day financial transactions, accountants perform high-level financial analysis, budgeting skills, and strategic financial planning. Bookkeeping is often seen as a subset of accounting that focuses on recording, categorizing, and reconciling financial transactions. Accountants analyze these records to prepare comprehensive financial documents and strategies.

2. How can I effectively prepare for accounting interviews?

Preparation for accounting interviews involves several strategies. First, familiarize yourself with common accounting job descriptions and sought-after skills. Additionally, practicing typical interview questions, researching the employing company, and preparing scenarios that demonstrate your problem-solving skills in accounting can greatly enhance your confidence. Consider crafting your own accounting portfolio to showcase relevant projects during your discussion.

3. What qualifications do I need to become a CPA?

To qualify as a CPA, you typically need at least a bachelor’s degree in accounting, pass the CPA exam, and meet specific work experience requirements. Some states also require additional coursework beyond the bachelor’s degree. As requirements vary between states, it is essential to familiarize yourself with the particular regulations in your area.

4. Is pursuing a specialization within accounting beneficial?

Pursuing a specialization, such as tax accounting or forensic accounting, can enhance your marketability and job prospects. Specialized knowledge demonstrates expertise in a particular area, often leading to higher salaries and unique career opportunities. Employers in specific sectors appreciate candidates who bring specialized skills relevant to their unique accounting environments.

5. How often should accountants pursue continuing education?

Accountants should pursue continuing education regularly to stay compliant with ever-changing regulations and enhance their professional skills. Participating in continued learning every year not only allows accountants to retain their licenses but also keeps them abreast of developments in technology and best practices within the field.

“`