Effective Ways to Build Business Credit in 2025: Discover Proven Strategies to Enhance Your Financial Profile

“`html

Effective Ways to Build Business Credit in 2025

Building robust business credit is essential for any enterprise looking to grow and maintain its financial integrity. In 2025, it will be more important than ever to establish a credible business credit profile. This article dives into proven strategies on how to build business credit, improve your business credit score, and navigate various business financing options.

Understanding Business Credit

Before you embark on your journey towards establishing and enhancing your business credit, it is vital to understand what it entails. Business credit is similar to personal credit; it is a measure of creditworthiness specifically for companies. This profile is determined by various factors, including financial history, business credit history, and overall performance in repaying debts. Lenders rely on this data to gauge risk, making it imperative for businesses to nurture a positive reputation.

The Importance of Business Credit Scores

Your business credit score can significantly impact your loan eligibility and terms. Just as individuals have credit scores, businesses are evaluated based on similar metrics. A good score can pave the way for business loans and favorable business credit cards. In contrast, a poor score could lead to higher interest rates or flat-out denial of credit. Hence, it’s essential to understand the factors that influence your score, like payment history and utilization of business credit lines.

Checking and Monitoring Your Business Credit

Regularly checking business credit is a proactive measure to identify any discrepancies. Using tools like online business credit reports can enlighten you about your current standing, revealing any errors that could impede your creditworthiness for businesses. Setting up a business credit monitoring system also helps in keeping track of any significant changes to your report, enabling you to act quickly and accurately.

Building Credit from the Ground Up

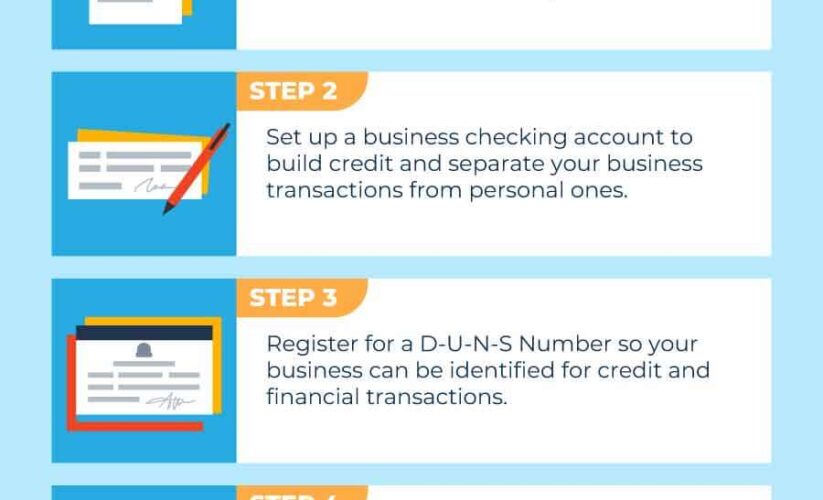

For startups or those with little credit history, the process of building business credit can appear daunting. However, implementing structured strategies can vastly improve your chances of establishing a solid credit profile early on. From registering your business with credit bureaus to ensuring compliance with all financial regulations, these foundational steps set the groundwork for sustained creditworthiness.

Registering with the Right Credit Bureaus

The first step in establishing business credit is to register with major business credit bureaus. TransUnion, Experian, and Dun & Bradstreet are the leading agencies that track credit activity. Obtaining a D-U-N-S Number is crucial, especially for larger ventures looking for federal funding. Having your business recognized by these bureaus legitimizes your operations, positioning you favorably when seeking business funding options.

Separating Personal and Business Credit

Another essential step is separating personal and business credit accounts. Mixing these two can lead to complications during evaluations and potentially lower your business credit score. Utilize business credit cards solely for business expenses, and ensure that your financial documentation reflects this separation clearly. This practice strengthens your overall credit profile and adds a layer of protection to your personal assets.

Strategies to Enhance Your Business Credit Visibility

Once you’ve established the basics, enhancing your business credit profile and visibility is essential. Cultivating strong relationships with suppliers, reporting your payment histories, and maintaining healthy credit utilization rates will give your business a competitive edge when it comes to applying for future loans or lines of credit.

Utilizing Suppliers that Report to Credit Bureaus

Partnering with suppliers that report to credit bureaus can significantly enhance your credit profile. These suppliers report your payment habits, which contribute to your business credit history. This method proves beneficial when aiming to improve your business credit score in a shorter period. Moreover, paying your invoices promptly and negotiating favorable terms can further bolster your credibility.

Responsible Use of Business Credit Lines

Maintaining business credit utilization ratios below 30% is key to a robust credit rating. This positive practice demonstrates to creditors that your business can manage credit responsibly. Ensure that your borrowing habits reflect sustainable practices; a cautious approach helps you avoid pitfalls in the event of unfavorable economic conditions.

Accessing Business Financing Options

Successfully leveraging your established business credit can open up a world of financing opportunities. Traditional business loans, business credit cards, and alternative funding can significantly boost your capital and foster growth initiatives. Understanding how to identify and choose the right financing options can set your venture on a path to success.

Types of Business Financing

Various business financing options exist to support growth, such as traditional loans for businesses, which often come at lower interest rates compared to other options. You may also explore merchant cash advances, lines of credit, and crowdfunding mechanisms. It’s imperative to assess the costs associated with each type, alongside the risk factors involved, before securing the necessary financial support.

Building Relationships with Financial Institutions

Fostering relationships with banks and other lending institutions can enhance your access to business financing options. Regular communication and maintaining an transparent transactional history further enrich these relationships. Banking partnerships may offer exclusive products or lower barriers to credit as you demonstrate a reliable financial standing.

Key Takeaways

- Understanding your business credit score is essential for getting better financing terms.

- Separating personal and business credit is crucial to building a healthy financial identity.

- Journaling your relationships with suppliers who report credit actively can cultivate your profile.

- Leveraging a proactive banking relationship will open doors for advantageous lending practices.

- Monitoring your business credit will help maintain transparency and accuracy in your financial dealings.

FAQ

1. What are the primary considerations in establishing business credit?

The key considerations include registering with major business credit bureaus, separating personal and business finances, and ensuring you consistently fulfill your payment obligations. Understanding what influences your business credit score is also critical for long-term financial health.

2. How can I check my business credit report?

You can access your business credit report through services provided by agencies like Dun & Bradstreet, Experian, and TransUnion. Some online platforms offer free monthly reports, helping you stay informed on any changes to your financial standing.

3. What role do suppliers play in building business credit?

Suppliers can significantly aid in building business credit by reporting your payment history to credit bureaus. Establishing favorable payment terms with these vendors will reflect well on your business credit profile, thus improving overall creditworthiness.

4. Can utilizing business credit cards benefit my credit score?

Yes, utilizing business credit cards responsibly, specifically by keeping your credit utilization low, can positively affect your business credit score. Prompt payments and responsible spending contribute to a healthier credit profile.

5. What financing options are available for startups looking to build credit?

Startups can consider various business financing options like small business loans, vendor financing, and lines of credit. Many of these options require establishing a good business credit history to qualify for favorable terms.

“`