Effective Ways to Find Expected Value: Practical Tips for 2025

Effective Ways to Find Expected Value

Understanding the Expected Value Concept

Expected value is a fundamental concept in statistics and probability theory, serving as a **calculation method** that helps assess the average outcome of uncertain scenarios involving **random variables**. It combines each possible outcome’s value with its associated probability, providing a weighted average that effectively summarizes the various results. This notion remains critical in fields such as finance, where it aids in making informed decisions under uncertainty. Understanding how to compute the **formula for expected value** is essential for anyone looking to analyze risks, forecast trends, or optimize decision-making processes.

The Formula for Expected Value

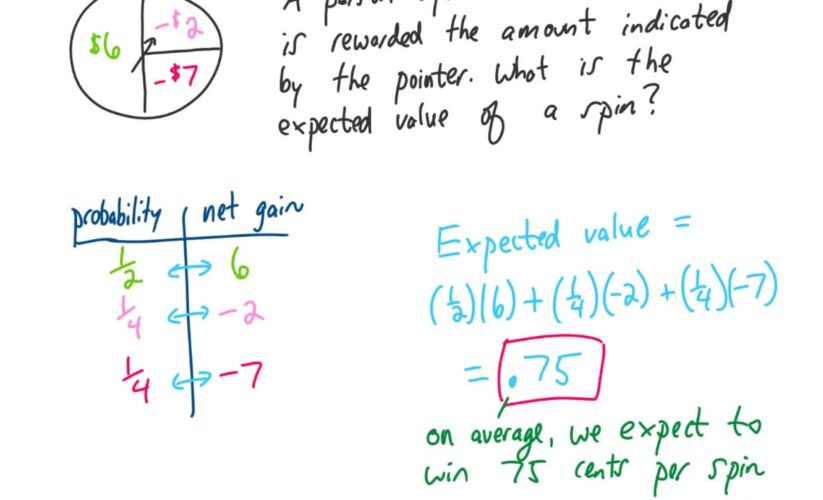

The **formula for expected value** (EV) is represented mathematically as follows:

EV = Σ (xi * P(xi))

where ‘xi’ represents the possible outcomes and ‘P(xi)’ denotes the probabilities associated with each outcome. This formula allows for straightforward calculations, especially when dealing with discrete distributions. By multiplying each outcome by its probability and summing these products, you arrive at the expected value. This computation plays a significant role in statistical analysis, particularly when evaluating options, predicting expected returns, or conducting risk assessments in finance: where understanding the average result can lead to improved decision-making strategies.

Applications of Expected Value in Decision Theory

In **decision theory**, the expected value concept is instrumental when making choices amid uncertainty. Decision-makers utilize expected value to weigh potential risks and rewards, allowing for an analysis based on probable outcomes rather than merely relying on intuition. Incorporating **expected utility** calculations can further refine decisions by factoring in individual risk preferences. For instance, when evaluating investment opportunities, understanding the expected return and the associated **payoff structure** helps in determining a strategy that aligns with one’s risk tolerance and financial goals, thus enhancing decision-making efficiency.

Calculating Expected Returns with Real-Life Examples

To illustrate the concept of expected value, consider a simple example involving a coin toss. In this case, you have two potential outcomes: heads, which nets a $10 win, and tails, which results in a $5 loss. The probabilities of each outcome are equally likely, at 50%. The expected value calculation would proceed as follows:

EV = (10 * 0.5) + (-5 * 0.5) = 5 – 2.5 = $2.50

This expected value indicates that, on average, you gain $2.50 per flip over time. Such analysis provides essential insights into outcome variability, critical for making financial decisions, designing games, or evaluating high-stake bets in **game theory**.

Expected Value and Probability Distributions

The relationship between expected value and **probability distributions** is profound. Probability distributions characterize how the probabilities of various outcomes are allocated. The expected value can differ significantly based on the shape of the distribution—whether it’s normal, skewed, or exhibits high kurtosis. Understanding these aspects is crucial for various applications, including **predictive modeling** and **quantitative forecasting**. Grasping how different distributions affect expected values can lead to more robust statistical insights and better risk assessments.

Analyzing the Mean of a Distribution

The **mean of a distribution** directly relates to expected value, as it can often represent the expected value for continuous random variables. When working with continuous random variables, calculating expected value involves integrating across the probability density function. For instance, if you have a distribution with different outcomes, the expected value reveals the point around which most of your potential outcome lies. This is particularly useful in **economic value** assessments, as it allows businesses to forecast future profitability based on historical performance data. Such methodological approaches not only enhance understanding but also facilitate empowered decision-making based on empirical evidence.

Expected Value in Financial Forecasting

In financial contexts, **expected value** plays a vital role in evaluating investment opportunities and predicting potential outcomes. By calculating the expected return on investments, financial analysts can assess which assets to prioritize and develop effective hedging strategies. For example, evaluating stock performance typically involves calculating their expected gains over a specific period, incorporating historical data and predicting future behaviors. Furthermore, understanding expected losses in scenarios such as defaults allows for proactive *_risk management_*, ensuring robust decisions in investment strategies and portfolio diversification.

Risk Assessment through Expected Value

Incorporating **risk assessment** into expected value calculations offers a comprehensive view of potential outcomes. Using various metrics such as **value at risk** (VaR) or analyzing potential **payoffs** can help delineate risk profiles associated with different investments. For instance, in stock trading, investors often use Monte Carlo simulations to assess financial viability under varied market conditions, estimating the expected outcomes and weighing them against the potential risks to achieve optimal portfolio configurations. This fusion of expected value with **multi-variable analysis** aids in delineating clearer paths for improving financial decision-making.

Advanced Techniques in Expected Value Calculation

Transitioning into more complex methodologies reveals additional layers within expected value calculations. Employing techniques such as **predictive modeling** and behavior-centric analyses often leads to deeper insights regarding average outcomes in uncertain conditions. Methods like Bayesian statistics further refine predictions by adjusting for prior knowledge through **expectation operators**, enhancing the evaluation accuracy of probable scenarios.

Expectation Operator in Data-Driven Decision Making

Understanding the **expectation operator** expands one’s toolkit for data-driven decision making. This operator helps revise the expected value considering new data or experiences, allowing businesses to formulate timely strategies based on recent trends rather than past assumptions. For instance, machine learning and AI applications extensively factor in the expectation operator to dynamically update their predictive models, ensuring outcomes remain relevant despite changing conditions. Such advancements in analytical tools continually reshape approaches to economic decision-making, keeping organizations responsive and organized within competitive landscapes.

Utility Maximization and Risk Management

Within the realm of economics, establishing a solid performance metric through **utility maximization** remains paramount. The goal is to optimize the expected value derived from financial assets while minimizing risks. Conducting analyses related to payoff structures surfaces insights that enable more strategic resource allocations within various scenarios. For example, employing simulations as a **decision support systems** can visualize potential outcomes, enhancing understanding of risk versus reward dynamics. Such layered analyses yield critical advantages for crafting informed decisions in progressively sophisticated environments.

Key Takeaways

- Expected value serves as a crucial metric for analyzing financial and probabilistic outcomes, providing insights into average returns and underlying risks.

- Calculating the expected value through its defined formula aids in decision theory, impacting choices in uncertain environments.

- Understanding the relationship between expected value and probability distributions allows for enhanced risk assessment and predictive analytics.

- Advanced techniques like the expectation operator and utility maximization deepen insights into real-world applications, optimizing decision-making processes.

FAQ

1. What is the significance of the expected value in finance?

The **expected value** in finance is significant for assessing potential earnings from investments by weighing the various probable returns against their associated risks. It serves as a foundational concept in **financial forecasting**, allowing investors to evaluate the viability of different asset classes and make informed strategic decisions.

2. How does expected value relate to probability distributions?

Expected value is calculated based on the outcomes defined within a **probability distribution**. Understanding these distributions allows analysts to assess how different scenarios influence the average outcomes, helping in risk assessment and evaluation of uncertainties in predictions.

3. Can expected value help in risk assessment strategies?

Absolutely. Expected value assists in identifying potential losses and profits under uncertain situations, allowing for informed risk management strategies. By integrating expected value with various metrics, organizations can better delineate risk profiles and develop tailored investment plans.

4. How is expected value utilized in decision-making under uncertainty?

In decision-making under uncertainty, expected value quantifies the outcomes associated with different choices, enabling individuals to evaluate their options based on likely results rather than intuition. It solidifies decision support systems by providing a calculated basis for selecting alternatives in uncertain conditions.

5. How can I calculate expected value in a real-life scenario?

To calculate expected value in a real-life scenario, identify all possible outcomes and their associated probabilities. Multiply each outcome’s value by its probability and sum these products. This provides the expected average result from repeated trials, aiding financial decisions or assessments of uncertain scenarios.