Effective Ways to Understand How to Find Marginal Cost in 2025

“`html

Understanding Marginal Cost: Definition, Calculation, and Implications

What is Marginal Cost?

The **definition of marginal cost** refers to the additional cost incurred to produce one more unit of a good or service. Understanding **marginal cost** is crucial for businesses as it directly impacts pricing strategies, profitability, and overall financial performance. In economics, marginal cost plays a vital role in determining production levels that maximize profit. By analyzing incrementally how production adjustments affect costs, firms can better manage their resources and optimize production efficiency. This concept balances between fixed and variable costs, helping firms strategize effectively in a dynamic market environment.

The Importance of Marginal Cost in Business

In the realm of **marginal cost in business**, understanding this concept allows for better decision-making, especially in pricing. When setting prices, businesses must consider the **marginal cost per unit** to ensure they cover costs while remaining competitive. **Marginal cost analysis** aids in identifying the contributions of different production levels to overall profit margins, fostering a strategic approach to supply and demand alignments and **cost structure analysis**. This analytical insight not only informs pricing models but also enhances profit maximization techniques and overall business strategy.

Common Methods for Calculating Marginal Cost

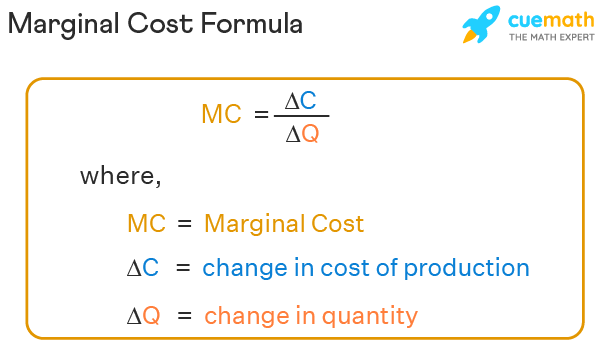

Calculating marginal cost can be achieved through various **marginal cost calculation methods**. Typically, it involves taking the change in total cost that results from producing an additional unit and dividing it by the change in output. The **marginal cost formula** can be expressed as:

Marginal Cost (MC) = Δ total cost / Δ quantity.

This straightforward calculation provides essential insights into the **marginal cost implications** for a business’s operational strategies and assists in long-term economic planning.

Real-World Application: Marginal Cost Example

Consider a manufacturing company that incurs total production costs of $10,000 for 1,000 units. If producing 1,001 units raises total costs to $10,010, the **marginal cost for decision making** would be (10,010 – 10,000) / (1,001 – 1,000) = $10. This example illustrates how **marginal cost analysis** influences production decisions and **profit margins analysis**, reflecting the significance of understanding incremental costs in production scenarios. Businesses need this kind of analysis to navigate financial sustainability better and growth opportunities aligned with market dynamics.

Marginal Cost versus Average Cost

Understanding the difference between **marginal cost versus average cost** is pivotal for both pricing strategies and cost management. While marginal cost focuses on the cost of producing one additional unit, average cost takes into account the total cost divided by the number of goods produced. This distinction helps firms make sound investment decisions and manage budget constraints effectively. Analyzing the **average total cost** alongside marginal cost allows businesses to pinpoint production efficiencies and identify cost optimization strategies that cater to both short-run and long-run production schemes.

Impact on Pricing Strategies

In the context of **marginal cost and pricing**, businesses leverage the information provided by marginal cost calculations to devise effective pricing strategies. By understanding their marginal cost curve, companies can assess how changes in output affect pricing decisions. Efficient pricing enables firms to remain competitive while ensuring profitability. This aspect is particularly crucial in contexts of price competition and economic modeling—where the decision of pricing adjustments influences not only sales figures but also market saturation and economic impacts.

Short Run vs. Long Run Marginal Cost

Understanding the differences between **short run marginal cost** and **long run marginal cost** helps businesses in capacity planning and production adjustments. In the short run, some costs are fixed, which means limited flexibility exists to adjust costs with changes in production. Conversely, in the long run, all costs can be adjusted, providing firms with greater operational flexibility. This reality showcases the importance of forecasting and resource allocation strategies, where businesses must evaluate their production capabilities against market demands to optimize overall performance dynamically.

Strategies for Marginal Cost Calculation

Implementing effective **marginal cost calculation methods** can enhance the efficiency of decision-making processes within businesses. With the aid of quantitative analysis and statistical techniques, firms can develop robust models to assess their costs effectively. Tools such as cost-benefit analysis can integrate with predictive analytics, enabling comprehensive evaluations that enhance understanding of how changes in production impacts overall profitability. By utilizing these strategies, organizations can adapt to market fluctuations, optimizing **resource allocation** based on solid data analytics and economic theories.

Utilizing Analytical Tools for Improvement

Leveraging advanced analytics such as **cost analysis** and **financial metrics** allows organizations to refine their marginal cost computations continually. By employing these methodologies, businesses engage in effective performance evaluation, which identifies operational inefficiencies and opportunities for cost-saving measures. Furthermore, using **marginal utility** concepts alongside marginal cost assists businesses in aligning production costs with consumer demand, thereby optimizing operational strategies.

Decision Making Based on Marginal Costs

Incorporating marginal costs into overall business decision-making processes empowers firms to evaluate various scenarios efficiently. In a competitive market, understanding how **marginal costs and profits** interact assists businesses in making informed decisions regarding pricing, production levels, and resource allocation. For instance, insight from **marginal cost calculations** can guide businesses in establishing break-even points and understanding pricing sensitivity in relation to demand shifts, which ultimately achieves optimal profit margins.

Key Takeaways

- Understanding marginal cost is vital for effective pricing and profitability optimization.

- Differences between marginal cost and average cost play a crucial role in production decision-making.

- Implementing effective marginal cost calculation strategies enhances financial stability and operational efficiency.

FAQ

1. How is marginal cost related to production decisions?

Marginal cost directly influences production decisions by assessing how much additional cost is incurred with each unit produced. Understanding this enables businesses to determine optimal production levels and set appropriate pricing strategies to maximize profits.

2. What role does marginal cost play in long-run economic planning?

**Marginal cost in production** provides insights into how costs behave as production scales. In long-run planning, firms can adjust practices based on these insights, ensuring sustainable operations and cost-efficiency over time.

3. Can marginal cost be considered in determining competitive advantage?

Yes, organizations can use **marginal cost** analysis to identify areas where they can cut expenses without impacting quality, thus providing a competitive edge in pricing strategies.

4. What’s the relationship between marginal cost and marginal revenue?

The relationship between **marginal cost** and **marginal revenue** is fundamental, as firms aim to set production levels where the cost of producing an additional unit equals the revenue generated by that unit—this balance maximizes profitability.

5. How can businesses use marginal cost calculations to improve profitability?

Businesses can analyze marginal cost calculations to identify optimal production levels, determine efficient pricing, and minimize costs. Such strategic insights foster better financial performance and enhanced profitability over time.

“`