Effective Ways to Use QuickBooks in 2025 for Streamlined Accounting and Better Management

“`html

Effective Ways to Use QuickBooks in 2025 for Streamlined Accounting and Better Management

In 2025, utilizing QuickBooks effectively can transform the way businesses manage their finances. This comprehensive guide provides insight into how to use QuickBooks for streamlined accounting and enhanced financial management. Whether you are a beginner or looking to optimize your current practices, the following sections will cover essential QuickBooks features, tips, and best practices.

Setting Up QuickBooks for Success

Establishing a solid foundation with QuickBooks begins with a well-structured setup. For users new to this software, understanding setting up QuickBooks correctly is vital. This includes selecting between QuickBooks Online or QuickBooks Desktop, depending on your business needs.

QuickBooks Setup Guide

The QuickBooks setup guide is your roadmap to efficient accounting. Start by determining your business structure, whether sole proprietorship or LLC, and then select the suitable QuickBooks version that best fits your needs. Familiarize yourself with the dashboard upon installation. A crucial step is to create your QuickBooks chart of accounts, which categorizes all financial transactions.

QuickBooks for Beginners

If you’re one of the many QuickBooks for beginners, it’s essential to utilize training resources available online. Engage in QuickBooks tutorials for small businesses that guide you through initial setups, such as connecting bank accounts through QuickBooks bank feed setup for seamless transactions. Take advantage of the built-in support features to answer preliminary questions.

Customizing Your QuickBooks Experience

Once you are familiar with the basics, look into customizing QuickBooks to better fit your operational needs. This may involve creating QuickBooks custom reports tailored to your financial analysis goals, or leveraging QuickBooks integrations with third-party applications for a holistic view of your business processes.

Overall, an effective setup empowers efficient financial management and is your first step towards mastering the use of QuickBooks.

Maximizing QuickBooks Features for Efficient Management

Once your QuickBooks setup is complete, learning how to maximize its features is crucial. Getting acquainted with QuickBooks invoicing, reporting, and payroll functionalities will significantly enhance your management capabilities.

Advanced QuickBooks Invoicing Techniques

Utilizing QuickBooks invoicing features correctly can streamline billing processes. Use customizable invoice templates that reflect your brand identity. Ensure to track payments and set reminders for outstanding invoices. Incorporate QuickBooks payment processing options to facilitate timely and secure transactions directly from your invoices.

Financial Reports and Analysis

Understanding QuickBooks reports is imperative. Regularly review financial statements such as balance sheets and profit and loss reports to gauge business health. Explore the different QuickBooks reporting tools that allow you to generate insights not merely from your expenses but by analyzing revenue streams as well, supporting informed decision-making.

QuickBooks Payroll Management

Efficient payroll management is essential for seamless operations. With QuickBooks payroll, automate employee payment processes and track hours using QuickBooks time tracking features. This reduces manual errors and ensures compliance with tax regulations.

Maximizing these features will optimize your operational workflows, contributing to better financial management.

QuickBooks Best Practices for Improved Financial Management

By following QuickBooks best practices, businesses can improve efficiency and organize their financial documentation systematically. Regular audits, enhanced financial forecasting, and ensuring data is backed up are critical in maintaining effective accounting workflows.

Expense Tracking and Budget Management

Effective QuickBooks expense tracking is fundamental. Regularly categorize expenses into relevant QuickBooks expense categories to analyze spending patterns. Leverage the budgeting features within QuickBooks to set financial goals, comparing historical data with projected expenses, thus supporting better financial planning.

Connecting QuickBooks with Other Business Tools

Integrating QuickBooks with other business tools enhances functionality. Connecting to CRM systems will help manage QuickBooks customer relationships. Analyze customer purchase histories using QuickBooks analytics to develop better marketing strategies.

Enhancing Customer Service Through QuickBooks

Utilize QuickBooks customer invoicing features to enhance client interactions. Fast invoicing can elevate customer satisfaction, coupled with timely follow-ups for overdue bills. Regular QuickBooks support ensures any encountered issues are swiftly resolved, maintaining customer trust.

Implementing these practices encourages sustainable financial health and seamless operations throughout the year.

Using QuickBooks for Growth and Expansion

Whether for small businesses or large companies, using QuickBooks effectively sets the stage for growth. Understanding financial metrics and making data-driven decisions guarantees scalability in any venture.

QuickBooks Financial Planning

Utilize QuickBooks financial management tools to forecast future growth accurately. Using historical data, QuickBooks budgeting tools allow businesses to allocate resources effectively. Frequent financial reviews help identify growth opportunities and mitigate potential risks.

Project Management with QuickBooks

Implementing QuickBooks for project management provides clear oversight of project expenses versus budgets. Use the job costing feature to keep track of expenses related to individual projects, ensuring profitability and resource optimization.

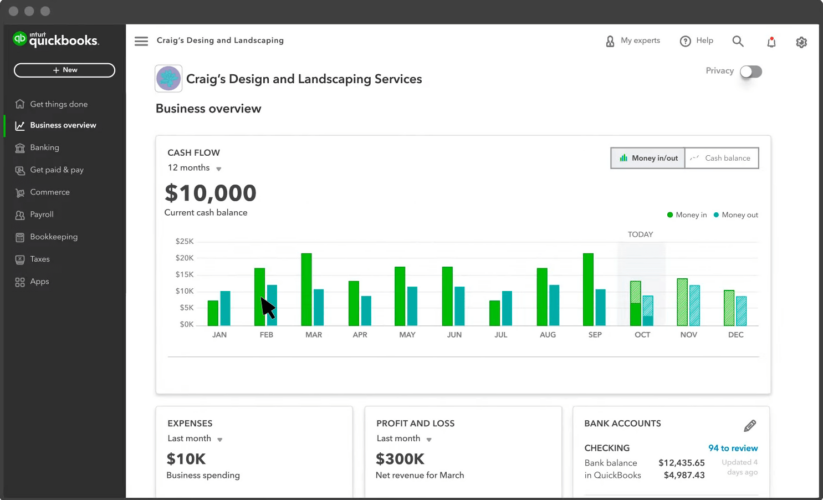

Leveraging QuickBooks for Data Insights

Finally, the analytics functionality within QuickBooks provides deep dives into business performance. Establish dashboards that reflect vital statistics such as cash flow and expenses, giving management necessary insights and facilitating timely interventions if required.

Through conscientious use of these features and strategies, businesses will position themselves for success utilizing QuickBooks.

Key Takeaways

- Set up QuickBooks correctly to ensure efficient operations and financial tracking.

- Maximize the use of key features such as invoicing, payroll, and reporting tools.

- Apply QuickBooks best practices for optimal financial management and budgeting.

- Utilize QuickBooks for strategic growth planning and project cost management.

FAQ

1. What features make QuickBooks valuable for small businesses?

QuickBooks offers customizable invoicing, user-friendly expense tracking, payroll management, and comprehensive reporting tools. The platform also assists with budgeting and has integration capabilities that streamline various accounting tasks, making it a valuable tool for small business financial management.

2. How can I ensure proper QuickBooks data backup?

Utilize the automated backup options available in QuickBooks. Schedule regular backups to an external hard drive or cloud storage. It is critical to frequently check backup logs to ensure all data is secured reliably.

3. Can QuickBooks be integrated with other applications?

Absolutely! QuickBooks integrations with various applications—including CRM systems, e-commerce platforms and payment processors—enhance workflows and improve overall operational efficiency.

4. What resources are available for QuickBooks training?

QuickBooks offers numerous training courses, including online resources, tutorials, and webinars aimed at teaching users how to master the software. The QuickBooks user community is also helpful for tips and troubleshooting.

5. Is QuickBooks suitable for freelancers?

Yes, QuickBooks for freelancers is an excellent choice, as it simplifies invoicing, expense tracking, and financial reporting. This software helps freelancers manage their finances efficiently, ensuring that they can focus on delivering services.

6. How does QuickBooks support tax preparation?

QuickBooks facilitates tax preparation by tracking all income and expenses throughout the fiscal year, categorizing transactions according to tax regulations. Generating reports helps users during tax season to ensure compliance and identifying any deductions available.

7. What options are available for QuickBooks customer support?

QuickBooks provides various levels of customer support, including online chat, forums, phone support, and detailed manuals. The support community is available to answer queries and help troubleshoot issues effectively.

“`