Smart Ways to Replace a Light Switch Easily in 2025 In an era where home improvement projects are gaining momentum due to increasing DIY enthusiasm, replacing a light switch is one task that can elevate both functionality and aesthetic appeal in your home. Whether you're aiming to upgrade to a stylish toggle or a smart switch that complements your energy-saving efforts,...

Smart Ways to Make a Blurry Picture Clear in 2025 Understanding Blurriness and Its Types Blurriness in images can occur due to various reasons, such as camera focus issues, motion blur, or low resolution. Understanding the type of blur affecting your photo is crucial in deciding how to effectively correct it. Camera shake can lead to motion blur, while incorrect focus may...

Effective Ways to Bake Ribs at 350°F for Perfect Results Baking ribs at 350°F can yield delicious outcomes if done with care and precision. Ribs, whether beef or pork, have a unique texture and flavor that make them a favorite choice for family gatherings and barbecues. Cooking ribs in the oven allows for better temperature control and moisture retention, giving you...

Effective Ways to Avoid Brain-Eating Amoeba: Stay Safe in 2025 Understanding the Brain-Eating Amoeba The brain-eating amoeba, formally known as Naegleria fowleri, is a rare but deadly organism found in warm freshwater environments. It can lead to severe brain infections, such as primary amoebic meningoencephalitis (PAM), particularly affecting those who expose their nasal passages to untreated water. With increasing temperatures, the risk...

Top 5 Practical Ways to Earn Money Online Without Investment in 2025 In today's digital age, the prospect of earning money online has become increasingly viable, even without any upfront investment. With traditional job markets evolving and the demand for flexible work arrangements growing, many individuals are exploring new opportunities to generate income from the comfort of their homes. This article...

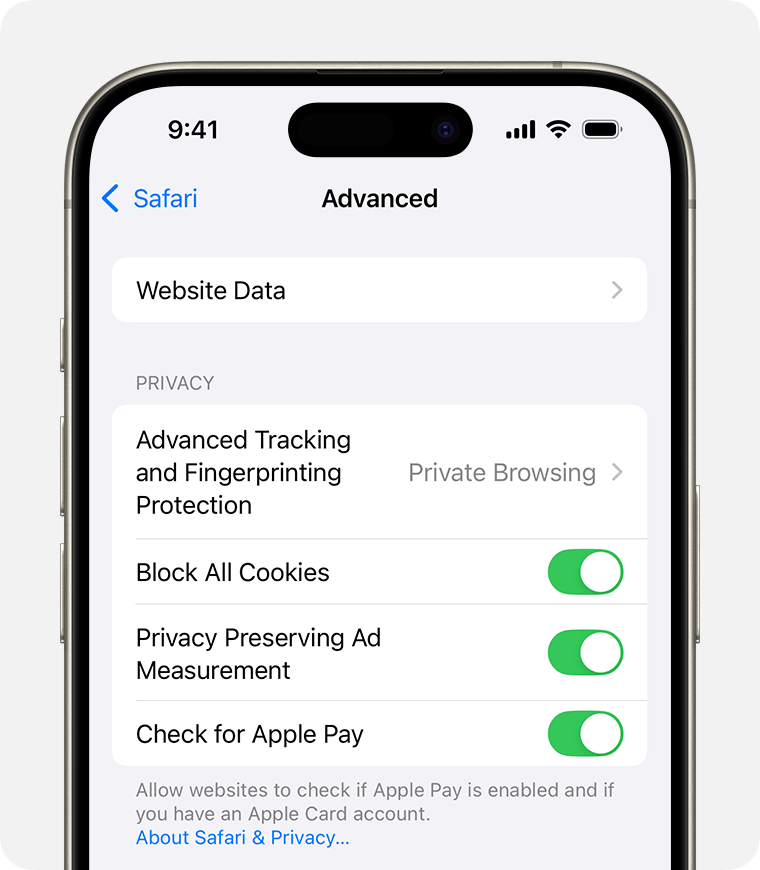

Effective Ways to Switch iPhones Seamlessly in 2025 Switching to a new iPhone can be an exciting yet daunting experience, especially with the rapid advancements in technology. In 2025, understanding how to switch iPhones seamlessly is crucial for ensuring a smooth transition from your old device. This article explores various methods for transferring data to a new iPhone, setting up applications,...

Essential Guide to Making Sofrito in 2025 Sofrito is a culinary cornerstone in many Latin American and Spanish kitchens, offering a vibrant mixture of flavors that can elevate any dish. As we move into 2025, the importance of crafting an authentic sofrito recipe remains paramount for engaging home cooks, food enthusiasts, and professional chefs alike. This guide delves into the essentials...

How to Properly Create a New iCloud Account in 2025 Creating a new iCloud account is essential for anyone looking to fully utilize the cloud services provided by Apple. With the growing need for secure data storage and device synchronization, establishing an iCloud account not only grants you access to various iCloud features but also enhances your overall Apple experience. In...

Effective Ways to Remove Duplicates in Excel 2025 In today's data-driven world, maintaining the integrity of your data is crucial, especially when working with Microsoft Excel. Duplicates can complicate data analysis and lead to errors in reporting. This guide will explore effective methods to remove duplicates in Excel as of 2025. From built-in functions to more advanced techniques, we will cover...

Effective Ways to Close a Chase Account in 2025 Closing a Chase account might be necessary for a variety of reasons, including finding better banking services, dissatisfaction with account fees, or changes in financial circumstances. Understanding the process of how to close a Chase account online or through other methods is essential to ensure it meets your personal banking needs. This...